The IRS Tax Form 8822 Overview

In the complex web of taxation, keeping up-to-date with changes becomes crucial. IRS tax form 8822 is one such key form for those needing to inform the IRS about certain changes. This article serves as your roadmap to understanding IRS Form 8822, also referred to as the Change of Address Form, to ensure the Internal Revenue Service can reach you correctly.

Understanding IRS Tax Form 8822

The importance of Form 8822 lies in its establishment of an essential line of communication between taxpayers and the IRS. Should your mailing or home address have recently changed, utilizing this form appropriately and promptly ensures that you continuously receive critical tax-related updates and documents. Whether it pertains to amendments, complications, or rebates, being oblivious to it may result in penalties that may be daunting.

Recent Updates to Form 8822 from IRS

Even static tax forms undergo revision, and the IRS 8822 form is no exception. The IRS frequently updates the IRS 8822 form PDF to maintain its relevance to evolving tax laws and conditions. In the most recent revision, specific changes include the inclusion of more detailed instructions and separation of home and business address changes into different sections. These changes showcase the IRS's commitment to making Form 8822 easier to read, understand, and fill out.

IRS Form 8822: the Eligibility Criteria for 2023

Notably, filing IRS Form 8822 is not a mandatory obligation for all taxpayers.

- If you haven't changed your address, or if your new address corresponds with the post office's records due to their respective changes, you're not obligated to file Form 8822.

- Additionally, representatives filing on a taxpayer's behalf need a signed Form 2848, Power of Attorney to make the change.

Related Forms to IRS Form 8822

While there isn't necessarily a need to attach copies to the 8822 IRS form when filing, it's crucial to keep your related documentation easily accessible should you need them in the future. Another critically related form is IRS Form 8822-B, which is utilized when a business changes its address or responsible party. Taxpayers and businesses must ensure they print IRS Form 8822 and 8822-B, keep them on file, and review their content diligently, ensuring accuracy in their address updates.

Easy Ways to File IRS Form 8822 Online

In the digital age, you have the convenience to file IRS Form 8822 online easily. Not only does digital filing promises less paperwork, but it also ensures quicker updates due to eliminating the mailing timespan. Moreover, cyber tools even integrate a walkthrough process, offering guidance to optimize and streamline the filing process, making it practicable and user-friendly.

Timely updating your mailing address is tremendously important, even across the seemingly little administrative updates like address timelines. Well-informed taxpayers, proactive in maintaining communication with the IRS, thrive in the tax landscape. Always remember that informed action in tax compliance helps you avoid complications, ensuring smooth sailing through the tax territory.

Stay ahead, diligently fill, print, and file your IRS 8822 form PDF.

Related Forms

-

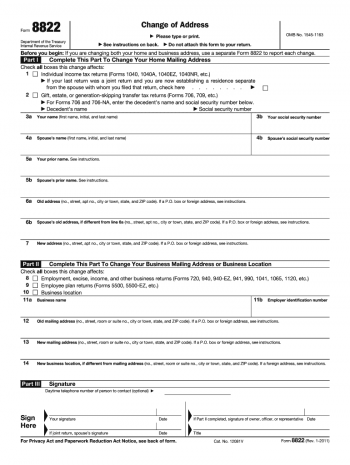

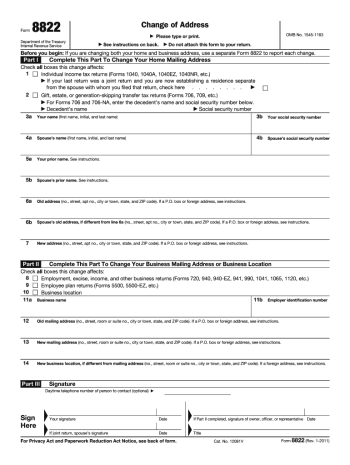

![image]() 8822 Introduced by the Internal Revenue Service (IRS), U.S. Form 8822 is implemented when taxpayers need to report a change of address or the personal details of the responsible party. It becomes essential when a discrepancy could arise in the mailing details or if the party is accountable for the tax return changes. This form enables the IRS to update its records efficiently and ensures taxpayers receive their respective correspondences at the correct location. Fill Now

8822 Introduced by the Internal Revenue Service (IRS), U.S. Form 8822 is implemented when taxpayers need to report a change of address or the personal details of the responsible party. It becomes essential when a discrepancy could arise in the mailing details or if the party is accountable for the tax return changes. This form enables the IRS to update its records efficiently and ensures taxpayers receive their respective correspondences at the correct location. Fill Now -

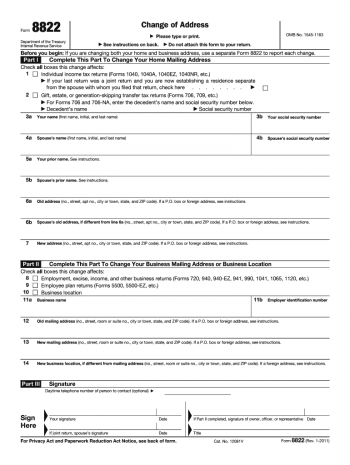

![image]() Form 8822 Printable Understanding tax forms, their structure, and their terms can often feel challenging for taxpayers - and the IRS Form 8822 printable is no exception. However, correctly updating your address information with the IRS is critical to ensuring you receive timely notifications and avoid any penalties stemming from missed correspondence. Printable Form 8822: Design & Structure The structure of Form 8822 printable is designed for simplicity and ease of use. It consists of a single-page document divided into two sections. The first section (Part I) collects basic details, like the old and new mailing addresses, while the second part (Part II) addresses changes in the business location, if applicable. The taxpayer must fill in the information accurately to avoid mistakes resulting in the letter or notice being sent to the wrong address. Filling Out the Blank 8822 Tax Form Here are some essential tips to keep in mind when filling out the 8822 form printable: Start by entering your name in the given space. If you're married, remember to fill in your spouse's name as well. Provide both your old and new addresses. If you had a foreign address, specify it in the form’s designated section. For a joint return, use the name and Social Security number (SSN) of the spouse whose SSN appears first on your return. Submitting Printable IRS Form 8822 Once you have filled out your free printable 8822 tax form, you must mail it to the appropriate IRS address stated in the form’s instructions. Make sure to keep a copy of the form for your records. Take note that you cannot currently submit IRS Form 8822 online, so ensure to plan for the mailing delay when updating your address. Due Date Ensure to submit your printable IRS tax form 8822 as soon as you change your address. Prompt submission allows the IRS to update your records and ensures all future communications reach you at your new address. The IRS doesn't provide a specific deadline for submitting Form 8822, but it's in the taxpayer's best interest to submit it as soon as possible. With this guide to complete and submit the IRS Form 8822 printable, taxpayers will find themselves better positioned to maintain ongoing communications with the IRS. Paying attention to every detail on the form, correctly completing it, and submitting it in a timely manner can avoid potential confusion, penalties, or other administrative challenges down the line. Fill Now

Form 8822 Printable Understanding tax forms, their structure, and their terms can often feel challenging for taxpayers - and the IRS Form 8822 printable is no exception. However, correctly updating your address information with the IRS is critical to ensuring you receive timely notifications and avoid any penalties stemming from missed correspondence. Printable Form 8822: Design & Structure The structure of Form 8822 printable is designed for simplicity and ease of use. It consists of a single-page document divided into two sections. The first section (Part I) collects basic details, like the old and new mailing addresses, while the second part (Part II) addresses changes in the business location, if applicable. The taxpayer must fill in the information accurately to avoid mistakes resulting in the letter or notice being sent to the wrong address. Filling Out the Blank 8822 Tax Form Here are some essential tips to keep in mind when filling out the 8822 form printable: Start by entering your name in the given space. If you're married, remember to fill in your spouse's name as well. Provide both your old and new addresses. If you had a foreign address, specify it in the form’s designated section. For a joint return, use the name and Social Security number (SSN) of the spouse whose SSN appears first on your return. Submitting Printable IRS Form 8822 Once you have filled out your free printable 8822 tax form, you must mail it to the appropriate IRS address stated in the form’s instructions. Make sure to keep a copy of the form for your records. Take note that you cannot currently submit IRS Form 8822 online, so ensure to plan for the mailing delay when updating your address. Due Date Ensure to submit your printable IRS tax form 8822 as soon as you change your address. Prompt submission allows the IRS to update your records and ensures all future communications reach you at your new address. The IRS doesn't provide a specific deadline for submitting Form 8822, but it's in the taxpayer's best interest to submit it as soon as possible. With this guide to complete and submit the IRS Form 8822 printable, taxpayers will find themselves better positioned to maintain ongoing communications with the IRS. Paying attention to every detail on the form, correctly completing it, and submitting it in a timely manner can avoid potential confusion, penalties, or other administrative challenges down the line. Fill Now -

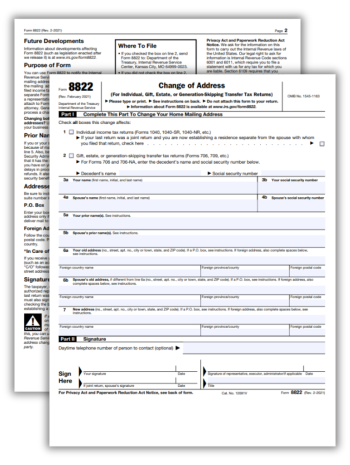

![image]() Form 8822 Instructions The American tax system often requires taxpayers to fill out various forms; one such document is the IRS Form 8822. With this guide, understanding the intricate ins and outs of Form 8822 instructions for 2023 becomes clearer. The Purpose of IRS Form 8822 This document, officially known as Form 8822, Change of Address, is used by taxpayers to inform the IRS about a change in their residential or business mailing address. Using this form is considered necessary when an individual, a corporation, a partnership, an estate, a trust, or an exempt organization has had a change in address that they have not yet communicated to the IRS. For individuals, this form can also be used to report a change of name due to marriage, divorce, or other circumstances. These details should be updated promptly with the IRS to avoid possible delays or miscommunications related to tax refunds or correspondence. Important Considerations with IRS Form 8822 Understanding the Form 8822 instructions sufficiently is crucial for the taxpayer to fulfill these obligations correctly. Some key components to consider include: Name of the taxpayerIf married and filing jointly, include both names in the order they appear on the tax return. The old and new addressesThe complete addresses, consisting of street, city, state, and ZIP code, must be provided. SignatureThe tax filer should sign and date the form. These are not exhaustive requirements but will give an idea of the key areas to give attention to in the IRS Form 8822 instructions. Avoid Common Mistakes in IRS Form 8822 While the form is relatively simple, a misunderstanding of the 8822 form instructions could lead to unnecessary errors. One common mistake people make is not including the tax form number(s) related to the address change. For example, if you file Form 1040, this number should be included in Form 8822. Another common error is forgetting to sign and date the copy. Form 8822 will not be processed without a proper signature; not including one can lead to delays. Therefore, be sure to sign and date the completed form. Lastly, another point of concern is not notifying the Internal Revenue Service promptly about the change of address. Remember to submit this change as soon as possible to avoid any discrepancies in your tax records. Understanding the instructions for IRS Form 8822 is extremely important to any individual or entity facing a changing address or name circumstance. Ensuring that all required keys for completing this form right not only reduces risks of delays or inconsistencies but also ensures smooth communication with the IRS. Fill Now

Form 8822 Instructions The American tax system often requires taxpayers to fill out various forms; one such document is the IRS Form 8822. With this guide, understanding the intricate ins and outs of Form 8822 instructions for 2023 becomes clearer. The Purpose of IRS Form 8822 This document, officially known as Form 8822, Change of Address, is used by taxpayers to inform the IRS about a change in their residential or business mailing address. Using this form is considered necessary when an individual, a corporation, a partnership, an estate, a trust, or an exempt organization has had a change in address that they have not yet communicated to the IRS. For individuals, this form can also be used to report a change of name due to marriage, divorce, or other circumstances. These details should be updated promptly with the IRS to avoid possible delays or miscommunications related to tax refunds or correspondence. Important Considerations with IRS Form 8822 Understanding the Form 8822 instructions sufficiently is crucial for the taxpayer to fulfill these obligations correctly. Some key components to consider include: Name of the taxpayerIf married and filing jointly, include both names in the order they appear on the tax return. The old and new addressesThe complete addresses, consisting of street, city, state, and ZIP code, must be provided. SignatureThe tax filer should sign and date the form. These are not exhaustive requirements but will give an idea of the key areas to give attention to in the IRS Form 8822 instructions. Avoid Common Mistakes in IRS Form 8822 While the form is relatively simple, a misunderstanding of the 8822 form instructions could lead to unnecessary errors. One common mistake people make is not including the tax form number(s) related to the address change. For example, if you file Form 1040, this number should be included in Form 8822. Another common error is forgetting to sign and date the copy. Form 8822 will not be processed without a proper signature; not including one can lead to delays. Therefore, be sure to sign and date the completed form. Lastly, another point of concern is not notifying the Internal Revenue Service promptly about the change of address. Remember to submit this change as soon as possible to avoid any discrepancies in your tax records. Understanding the instructions for IRS Form 8822 is extremely important to any individual or entity facing a changing address or name circumstance. Ensuring that all required keys for completing this form right not only reduces risks of delays or inconsistencies but also ensures smooth communication with the IRS. Fill Now -

![image]() IRS Form 8822 Online As a US taxpayer, you already know how important it is to disclose any changes in your contact information to the IRS. To ensure accurate and timely communication, one must update their records through IRS Form 8822. So what is this form? IRS Form 8822, Change of Address, is a document that will notify the Internal Revenue Service about changes to your mailing address. Traditional paper forms should be mailed, but now it's also possible to file IRS Form 8822 online. Features of IRS Form 8822 Online Going digital has a few advantages. Topping the list is the convenience and speed, which allows you to submit an electronic IRS 8822 form online from the comfort of your home or office. The online form ensures accuracy as it inspects for errors before being submitted. Furthermore, this avoids potential losses or discrepancies that could result from mishandling paper forms. The digital form also contributes to environmental stewardship by minimizing paper waste. Possible Difficulties Filing the 8822 Online Despite its apparent convenience, there might be some roadblocks when you decide to file IRS Form 8822 online. One challenge is the necessary internet access and a certain level of digital literacy. Not everybody is comfortable with navigating through digital platforms, and the IRS online system might be intimidating to novice users. Additionally, online submitters must understand the importance of following instructions to the letter to avoid any potential issues that could lead to your form being rejected. Online forms also entail a strong need for secure, private internet connections to guard against potential phishing or cyber-security threats. Recommendations for Successful Completion To facilitate a successful filing, here are some tips: Before you start, gather all the necessary paperwork to ensure that you have all the information needed at hand. Take your time to read and understand each section of the form carefully. Ensure that all required fields on the 8822 form online are accurately filled. Lastly, check that your internet connection is secure to safeguard your personal information. Guide to Fix Possible Pitfalls If you're having trouble filling out the PDF or can't e-file IRS Form 8822 with your tax preparation software, the first step is to contact the software's customer support for guidance. They should be able to help you navigate and understand the program's process and prompts. If you still find difficulty, consider hiring a tax professional to assist you. They have the expertise to simplify complex tax concerns and can file the form for you. Finally, if you prefer to fill out the form personally, you could download it from the IRS website, fill it out manually and mail it according to the instructions provided. With these helpful suggestions, filing the IRS Form 8822, Change of Address, online should be a relatively straightforward affair. But remember, when it comes to managing your taxes and handling sensitive information, attention to detail is paramount. Fill Now

IRS Form 8822 Online As a US taxpayer, you already know how important it is to disclose any changes in your contact information to the IRS. To ensure accurate and timely communication, one must update their records through IRS Form 8822. So what is this form? IRS Form 8822, Change of Address, is a document that will notify the Internal Revenue Service about changes to your mailing address. Traditional paper forms should be mailed, but now it's also possible to file IRS Form 8822 online. Features of IRS Form 8822 Online Going digital has a few advantages. Topping the list is the convenience and speed, which allows you to submit an electronic IRS 8822 form online from the comfort of your home or office. The online form ensures accuracy as it inspects for errors before being submitted. Furthermore, this avoids potential losses or discrepancies that could result from mishandling paper forms. The digital form also contributes to environmental stewardship by minimizing paper waste. Possible Difficulties Filing the 8822 Online Despite its apparent convenience, there might be some roadblocks when you decide to file IRS Form 8822 online. One challenge is the necessary internet access and a certain level of digital literacy. Not everybody is comfortable with navigating through digital platforms, and the IRS online system might be intimidating to novice users. Additionally, online submitters must understand the importance of following instructions to the letter to avoid any potential issues that could lead to your form being rejected. Online forms also entail a strong need for secure, private internet connections to guard against potential phishing or cyber-security threats. Recommendations for Successful Completion To facilitate a successful filing, here are some tips: Before you start, gather all the necessary paperwork to ensure that you have all the information needed at hand. Take your time to read and understand each section of the form carefully. Ensure that all required fields on the 8822 form online are accurately filled. Lastly, check that your internet connection is secure to safeguard your personal information. Guide to Fix Possible Pitfalls If you're having trouble filling out the PDF or can't e-file IRS Form 8822 with your tax preparation software, the first step is to contact the software's customer support for guidance. They should be able to help you navigate and understand the program's process and prompts. If you still find difficulty, consider hiring a tax professional to assist you. They have the expertise to simplify complex tax concerns and can file the form for you. Finally, if you prefer to fill out the form personally, you could download it from the IRS website, fill it out manually and mail it according to the instructions provided. With these helpful suggestions, filing the IRS Form 8822, Change of Address, online should be a relatively straightforward affair. But remember, when it comes to managing your taxes and handling sensitive information, attention to detail is paramount. Fill Now -

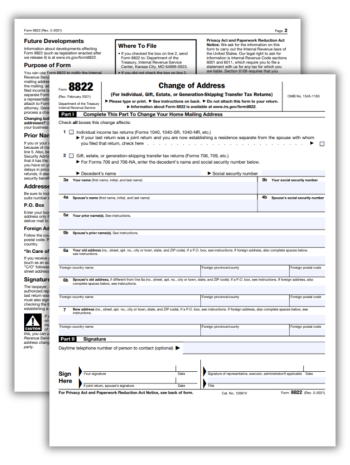

![image]() IRS Form 8822: Change of Address When you change your place of residence, it is essential to inform various government departments, including the IRS, about your current address. It's vital to note that they won't adjust your address based on the one written on your tax form's envelope. You need to use a different process to change your address officially in their records. Essentially, you need to fill and forward Form 8822, Change of Address, to the IRS. Let's delve deeper into situations when you might need this form and how precisely to use it for your potential benefits. The 8822 Form & Change of Address Example Typically, you are bound to submit the IRS 8822 (Change of Address) form when you shift your domicile to a fresh location. For instance, say you were a Massachusetts resident and recently had a job transfer to Colorado. You would want the IRS to send their correspondence to Colorado, not the previous Massachusetts address. Therefore, you must submit this form to update your information officially in IRS records. People usually confuse this item with filing returns. Remember, sending your tax returns from a new address does not automatically adjust your registered address with the IRS. Guide to Filling Form 8822 to the IRS Often, people inquire about how to get their hands on the IRS Form 8822 for a change of address online. It is a straightforward procedure: Visit our website and scroll to the top to open Form 8822 in the online editor as a PDF. Download it, and print IRS Form 8822, Change of Address. Pay attention to the quality of the printable copy. The ink must be bright, and the text must be readable. After effectively printing the form, you need to populate it with the necessary data, which includes: your old and new physical address, the specific date you moved, Social Security Number or Employer Identification Number. Then mail this form directly to the IRS, and your address should be updated in four to six weeks. IRS Form 8822: Alternatives for Non-Residents Now, we have understood how to fill out the printable IRS Form 8822, Change of Address. What happens if you're a non-resident? What action should one take, then? In light of the distinctive needs of non-residents or aliens, the IRS furnishes distinct forms to cater according to the applicable exceptions. IRS form 8822-B can serve those individuals who alter their normal business or dwelling place. Frequently Asked Questions If I made an error on my 8822 Form when submitting it to the IRS, what's the appropriate next step?Generally speaking, mistakes are easily correctable. All that's required is filling out a new form with the correct information and sending it to the IRS. This way, the error can be amended in a timely fashion. I have started sending my tax returns from a new address. Will this update my previous one with the IRS?Unfortunately, it does not automatically update your previous one recorded with the IRS. You are required to complete and submit the formal Form 8822. If you fail to do so, your registered address won't be updated, irrespective of how often you mail your returns from your new address. How do I know the address to file Form 8822 to the IRS?Check out the latest instructions for the 8822 tax form and check the address and additional rules to file your copy correctly to the proper address. Remember, remaining updated on tax matters and knowing your responsibilities regarding form submissions is important to maintaining a healthy financial life. Fill Now

IRS Form 8822: Change of Address When you change your place of residence, it is essential to inform various government departments, including the IRS, about your current address. It's vital to note that they won't adjust your address based on the one written on your tax form's envelope. You need to use a different process to change your address officially in their records. Essentially, you need to fill and forward Form 8822, Change of Address, to the IRS. Let's delve deeper into situations when you might need this form and how precisely to use it for your potential benefits. The 8822 Form & Change of Address Example Typically, you are bound to submit the IRS 8822 (Change of Address) form when you shift your domicile to a fresh location. For instance, say you were a Massachusetts resident and recently had a job transfer to Colorado. You would want the IRS to send their correspondence to Colorado, not the previous Massachusetts address. Therefore, you must submit this form to update your information officially in IRS records. People usually confuse this item with filing returns. Remember, sending your tax returns from a new address does not automatically adjust your registered address with the IRS. Guide to Filling Form 8822 to the IRS Often, people inquire about how to get their hands on the IRS Form 8822 for a change of address online. It is a straightforward procedure: Visit our website and scroll to the top to open Form 8822 in the online editor as a PDF. Download it, and print IRS Form 8822, Change of Address. Pay attention to the quality of the printable copy. The ink must be bright, and the text must be readable. After effectively printing the form, you need to populate it with the necessary data, which includes: your old and new physical address, the specific date you moved, Social Security Number or Employer Identification Number. Then mail this form directly to the IRS, and your address should be updated in four to six weeks. IRS Form 8822: Alternatives for Non-Residents Now, we have understood how to fill out the printable IRS Form 8822, Change of Address. What happens if you're a non-resident? What action should one take, then? In light of the distinctive needs of non-residents or aliens, the IRS furnishes distinct forms to cater according to the applicable exceptions. IRS form 8822-B can serve those individuals who alter their normal business or dwelling place. Frequently Asked Questions If I made an error on my 8822 Form when submitting it to the IRS, what's the appropriate next step?Generally speaking, mistakes are easily correctable. All that's required is filling out a new form with the correct information and sending it to the IRS. This way, the error can be amended in a timely fashion. I have started sending my tax returns from a new address. Will this update my previous one with the IRS?Unfortunately, it does not automatically update your previous one recorded with the IRS. You are required to complete and submit the formal Form 8822. If you fail to do so, your registered address won't be updated, irrespective of how often you mail your returns from your new address. How do I know the address to file Form 8822 to the IRS?Check out the latest instructions for the 8822 tax form and check the address and additional rules to file your copy correctly to the proper address. Remember, remaining updated on tax matters and knowing your responsibilities regarding form submissions is important to maintaining a healthy financial life. Fill Now